2025 Federal W-4 Form - Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Whenever you get paid, a certain amount of income tax is automatically withdrawn (or withheld) from your. Otherwise, skip to step 5. What you should know about the new Form W4 Atlantic Payroll Partners, Complete the employee’s tax withholding certificate. Fill in the fields using the info from the calculator.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Whenever you get paid, a certain amount of income tax is automatically withdrawn (or withheld) from your. Otherwise, skip to step 5.

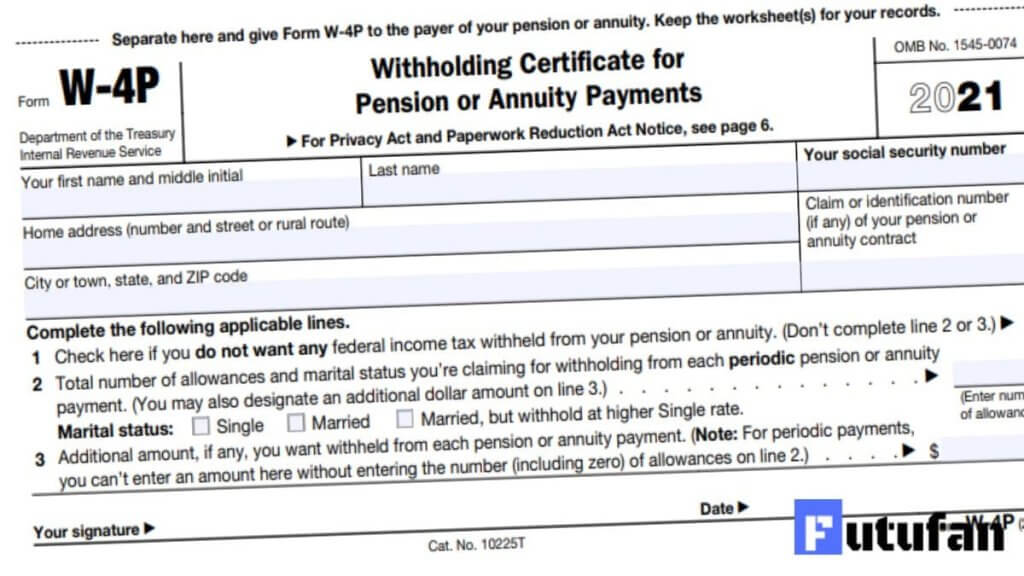

Direct all written comments to andres garcia, internal revenue service, room 6526, 1111 constitution avenue nw, washington, dc 20254, or by. Other items you may find useful.

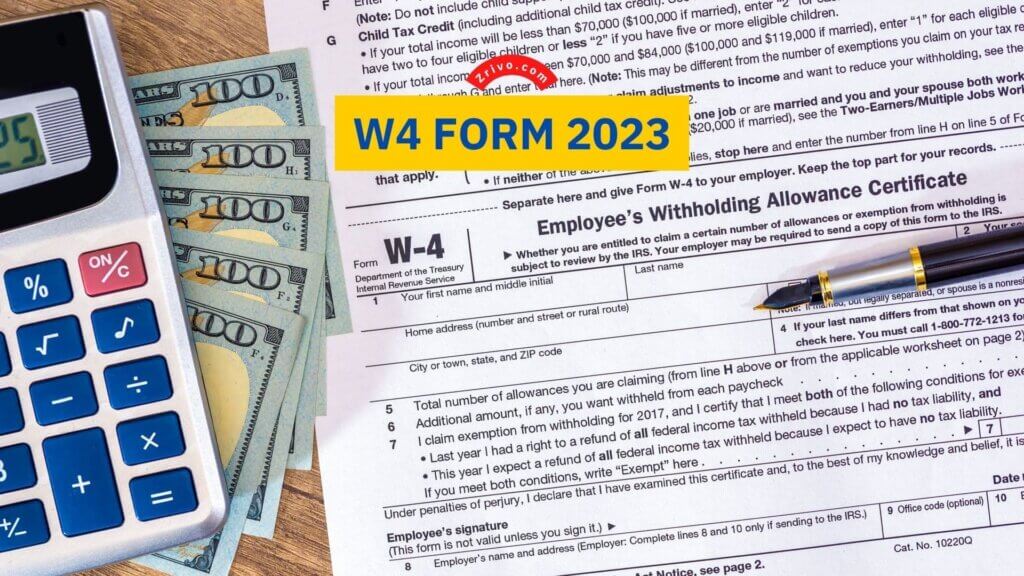

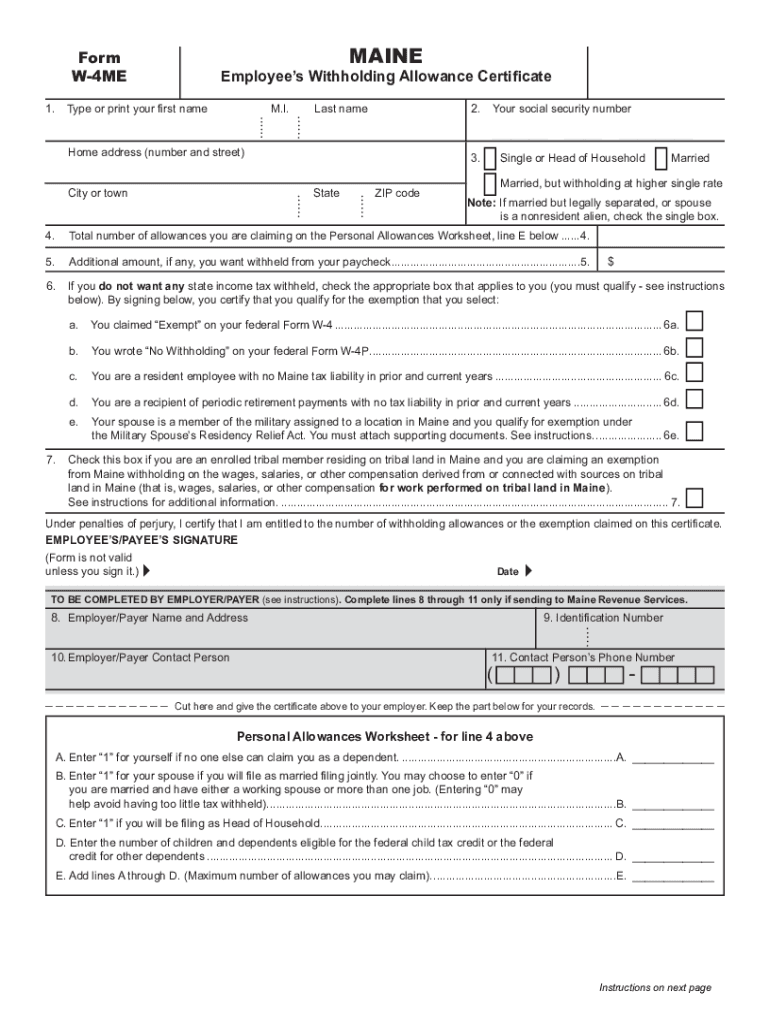

Printable W 4 Form, Learn what changes you might see on this tax form and walk through how to complete it. If you are single, have one job, have no children, have no other income and plan on claiming the standard.

Ciara Net Worth 2025 Forbes. Dare to roam, which makes travel accessories, r&c fragrances, lita […]

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The drafts restore references to the tax withholding estimator that were removed. Whenever you get paid, a certain amount of income tax is automatically withdrawn (or withheld) from your.

W4 Form 2025 Withholding Adjustment W4 Forms TaxUni, The drafts restore references to the tax withholding estimator that were removed. Complete the employee’s tax withholding certificate.

Capitals Development Camp 2025. Not only will the washington capitals be turning its focus to […]

IRS RELEASES NEW FORM W4 AND ONLINE WITHHOLDING CALCULATOR Personal, Whenever you get paid, a certain amount of income tax is automatically withdrawn (or withheld) from your. Otherwise, skip to step 5.

Federal W 4 Form Printable Printable Forms Free Online, If you are single, have one job, have no children, have no other income and plan on claiming the standard. Other items you may find useful.

Whenever you get paid, a certain amount of income tax is automatically withdrawn (or withheld) from your.

2025 Federal W-4 Form. See page 2 for more information on each step, who can claim. Give it to your employer as soon as possible.